Creditors Give up on Anil Ambani Group Following Loss of 12,600 Crore

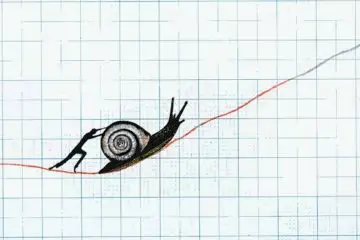

Money lenders gave up on the shares of Anil Ambani group companies which they owned as collateral soon after their market value dropped by Rs 12,600 crore [app. $1.8 billion] in this month, further summing to the collection of sorrows to the disturbing Indian billionaire.

Creditors sold off 5.5 billion total shares in four companies namely Reliance Infrastructure, Reliance Power, Reliance Capital and Reliance Communications which lead to 3 to percent point decrease in the founder’s stakes in these companies, as per the filings.

The sentiment of the fragile investor for the Anil Ambani group dealt with another shock after its wireless unit, Reliance Communications, reported on last Friday that it is planning to file for bankruptcy. The selloff has extended to another group of firms as a week, further decreasing the value of the shares that were promised as collateral.

IDBI Trusteeship Services which controls Reliance Power shares mentioned that the assets were sold because the borrowers defaulted on the terms.

Reliance communication has observed the decline in the market value by almost more than half during this week; meanwhile, the shares of Reliance Infrastructure and Reliance Power have significantly dropped by 60 percent each. Reliance Capital has dropped by 34 percent.

The issue of the share pledge has plunged other Indian companies too. Media tycoon Subhash Chandra’s of Essel Group agreed upon a contract by signing it with the lenders that secure the group’s borrowing against shares from being totaled up to 30 September, even if their value declines. On January 25, the agreement was followed by a 27 percent drop in the flagship Zee Entertainment Enterprises.